NC DoR CD-401S 2025-2026 free printable template

Show details

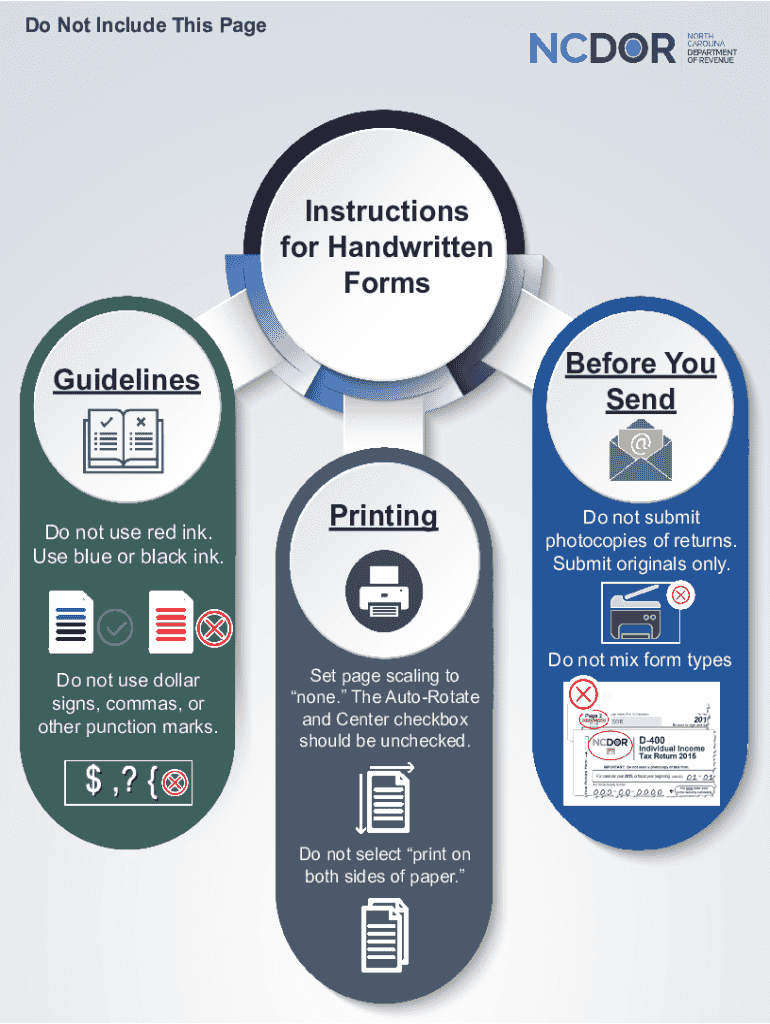

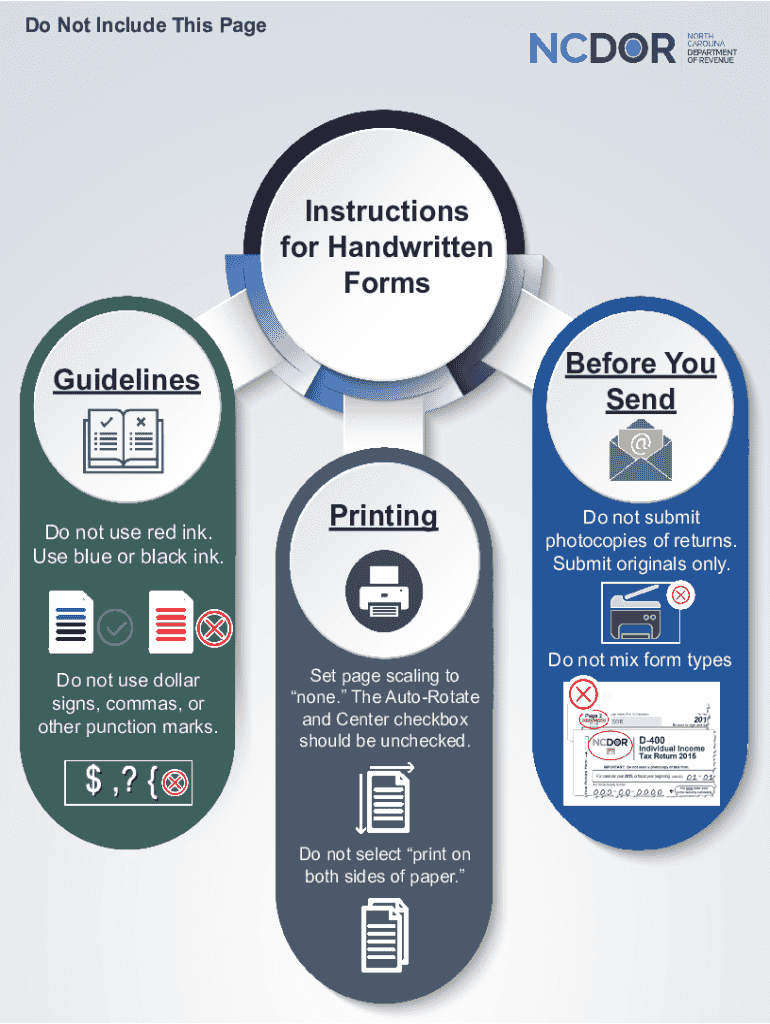

Do Not Include This PageInstructions

for Handwritten

Forms

Before You

SendGuidelinesDo not use red ink.

Use blue or black ink.Do not use dollar

signs, commas, or

other punction marks.PrintingSet page

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC DoR CD-401S

Edit your NC DoR CD-401S form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC DoR CD-401S form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NC DoR CD-401S online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NC DoR CD-401S. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC DoR CD-401S Form Versions

Version

Form Popularity

Fillable & printabley

Fill

form

: Try Risk Free

People Also Ask about

What is the tax form for an LLC in NC?

File Form CD-405 with the Department of Revenue.

What is the Nexus threshold in NC?

All remote sellers having gross sales in excess of one hundred thousand dollars ($100,000) sourced to North Carolina or two hundred (200) or more separate transactions sourced to North Carolina in the previous or current calendar year (collectively "Threshold") must register to collect and remit sales and use tax to

Who has to pay franchise tax in North Carolina?

Every corporation doing business in North Carolina and every inactive corporation chartered or domesticated here must file an annual franchise and income tax return using the name reflected on the corporate charter if incorporated in this State, or on the certificate of authority if incorporated outside this State.

What is NC CD 401S?

A taxpayer that receives an automatic extension to file a federal corporate income tax return will be granted an automatic state extension to file the N.C. S-Corporation tax return, Form CD-401S.

What creates income tax nexus in North Carolina?

What is the North Carolina nexus standard? North Carolina employs an economic presence income tax nexus standard. The corporate income tax is imposed on every corporation doing business in North Carolina.

What triggers Nexus in North Carolina?

North Carolina Tax Nexus Generally, a business has nexus in North Carolina when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the NC DoR CD-401S in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your NC DoR CD-401S directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit NC DoR CD-401S on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing NC DoR CD-401S right away.

How do I complete NC DoR CD-401S on an Android device?

Use the pdfFiller app for Android to finish your NC DoR CD-401S. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your NC DoR CD-401S online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC DoR CD-401s is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.